How to deduct the commission paid to the real estate agency

How to deduct the commission paid to the real estate agency

This time I’ve prepared for you an article that will help you to deduct your agents’ commissions from income denunciation.

In Italy, the deduction under consideration was introduced with effect from 1 January 2007 by Law no. 248 of 2006, in connection with the obligation to indicate in real estate transactions the amount eventually paid by the buyer and seller to the estate agents (Legislative Decree 223/06).

The remuneration paid to real estate brokers for the purchase of a building to be used as primary home may be deducted at the rate of 19%, up to a maximum of € 1,000.

The deduction is exclusively for the buyer of the property; The seller can not therefore benefit from the deduction under consideration even though he has paid the relevant commission to the real estate broker. The deduction does not apply if the expenses are incurred in the interest of the taxable family members.

If the real estate unit is purchased by more than one person, the deduction, within the limit of 1000 euros, shall be shared by the co-owners on the basis of the percentage of ownership.

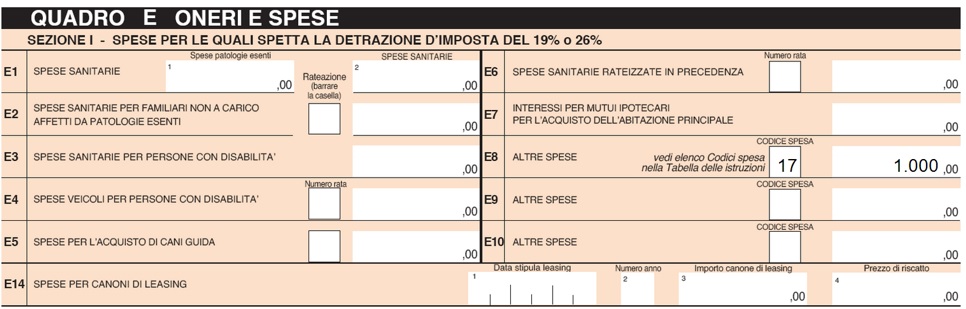

For the purposes of the recognition of the tax benefit, the E line from E8 to E10 of model 730/2017 (or RP model of the Redditi PF 2017 model) must be completed with the inclusion of expenditure code 17.

In order to obtain a deduction, the taxpayer must submit:

1) Invoice issued by the realtor.

2) Copy of the notarial deed for the sale of the property in which they are shown:

- The amount of expenditure incurred for mediation;

- The analytical methods of payment;

- The VAT number or tax code of the realtor.

In short, if you look good, the deduction is not so much, but it is always better than nothing.

For any information about the process of buying a house in Italy, write to info@ortalloggi.com, I will be happy to answer your questions.

Alice – www.ortalloggi.com

Sources (in Italian):