Taxes on Buying a House in Italy

TAXES ON BUYING A HOUSE IN ITALY

The topic “taxes” in Italy is always tricky and hard to understand. We can say, however, that the purchase of a real estate property taxes are quite transparent and that the Inland Revenue (Agenzia delle Entrate), as we shall see, tries to give all the information possible.

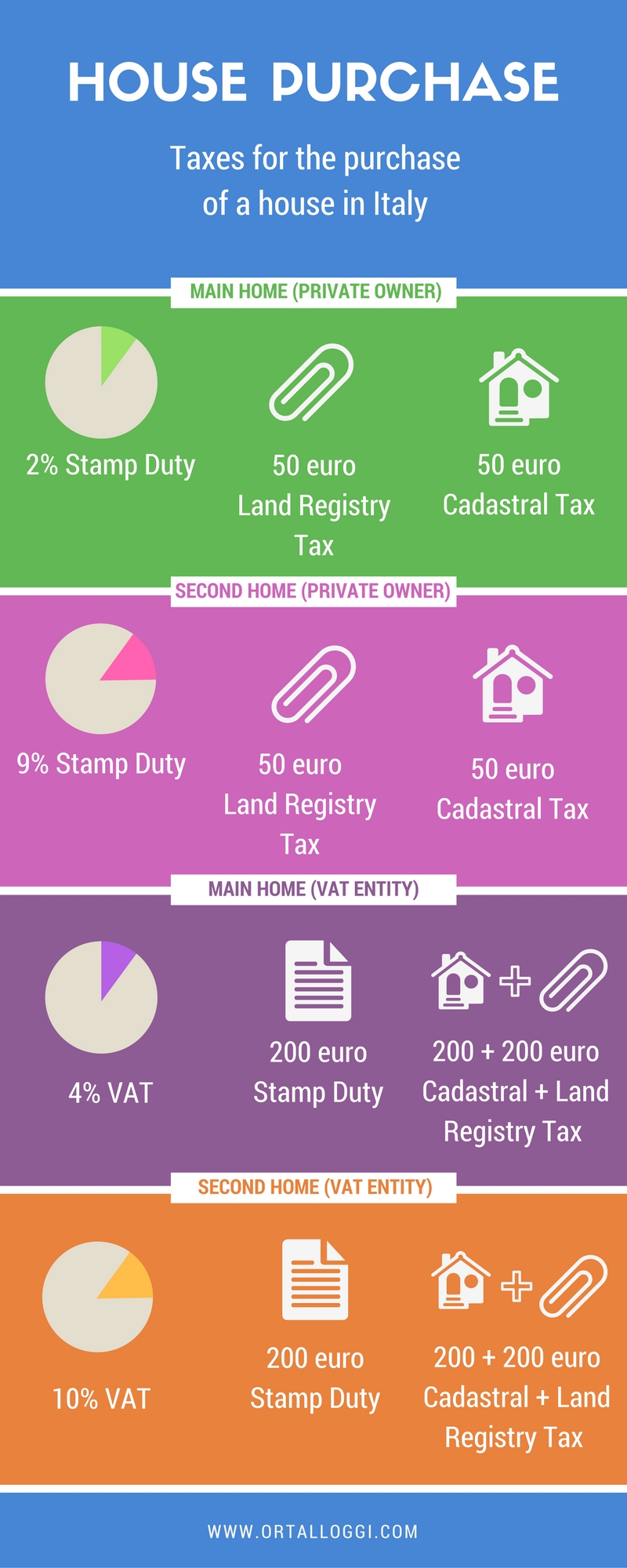

In addition to what you see in the image below, there are some distinctions about the company that have a sales-free or subject to VAT. For simplicity, I have provided only if the company subject to VAT because it is the most frequent. Even the luxury houses may have different taxation. I am always available for any clarification, please write me to info@ortalloggi.com.

If it is not the purchase of a main residence (second home or luxury property) and you buy from a private seller, stamp duty of 9% is due, land registry tax in a fixed sum of €50, and cadastral tax in a fixed sum of €50.

The same goes if you are purchasing from a construction company that sells the property after 5 years from the completion of the work, and decides not to charge VAT in the deed of sale.

If it is the purchase of a primary residence, the stamp duty will be 2%, whereas the land registry and cadastral tax will remain the same.

In the case of both a main and second home, the amount due for the stamp duty will never be less than €1,000.

If you buy from a construction company within five years from the completion of the work (or decide to submit the deed of sale with VAT even though five years have already passed since the completion of the work), things change. Then the stamp duty, land registry and cadastral tax will be €200 each, and VAT of 4% will have to be paid if you are purchasing a main residence, or 10% if you are purchasing a second home.

We must above all keep in mind that in the case of a private sale, therefore subject to Stamp Duty in percentage, it is calculated on the cadastral value and not on the purchase price.

Conversely, in the case of a sale subject to Iva it is the price of the property.

Don’t be discouraged by this list of taxes and cases, getting your perfect retreat in the ‘boot-shaped’ country is far much easier and affordable than one may expect.

It is important to check exactly what and how much to must pay with the help of a professional.

The Inland Revenue (Agenzia delle Entrate) has prepared a guide in pdf where it elaborates this topic. Ask me for read this paper, the language in which it is written, though, is Italian.

You must forgive me if my English is not professional, I do my best to help my clients.

Alice – www.ortalloggi.com

#ortalloggi #lakeforlike #lakeorta #italy #lookingforsecondhome #acquistocasa #fasiacquistoimmobilaire #casa #nuovacasa #agenziaimmobiliare #realestateagency #tasse #taxes