Italian tax code for foreigners

Italian tax code for foreigners

For us, Italians, the tax code (fiscal code) is part of our documents. It is a unique identification number.

It follows us in all the affairs of life (hospital, taxes, purchases, etc.). When a foreigner buys or rents something in Italy we have to ask for this code.

The request and its release are completely free.

Once you have this document, it will follow you in all matters, that you will do in Italy.

The fiscal code is an alphanumeric code of 17 characters.

The first six are letters and refer to the name and the surname, then there are two numbers for the year of birth, then there is a letter that refers to the month of birth (according to a specific table) then two numbers for the day of birth (for women only to the day of birth number adds 40), then add a letter and three numbers for your country or the foreign state of birth, finally, a letter which is a control character.

Don’t you worry, there are special programs that create this code, we should not do it by hand. But I think it’s nice for you, understanding how the code is made.

How to receive the fiscal code (free)

You have to go to the Inland Revenue, I will do it for you if you want, but you must fill out the form found attached. There are many different languages, you can choose the one you prefer. I will explain how to complete the form in English, but the form is the same for all other languages.

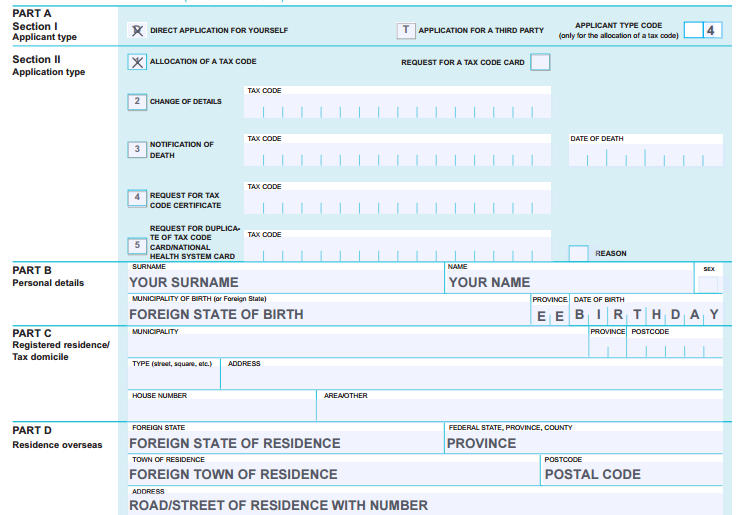

We start with the part A. You must tick the “D” box (DIRECT APPLICATION FOR YOURSELF) even if you delegate me to go get the fiscal code.

How APPLICANT TYPE CODE choose the code 4, which means other types of direct request (differ from student, worker and subject temporarily present on Italian soil).

In the second section, mark the box number 1 (A ALLOCATION OF TAX CODE) which is reserved for people who have never had the fiscal code.

Then you fill in part B with all your information is correct mark as “EE” province because it means foreign. If you were born in Italy marks the initials of your province.

PLEASE NOTE: in the name field, you must specify all your names. If in the passport you have scored more than one name, even if you do not use them normally, you must specify all your names.

If you do not have a residence in Italy does not compile the field C, but go directly to the field D.

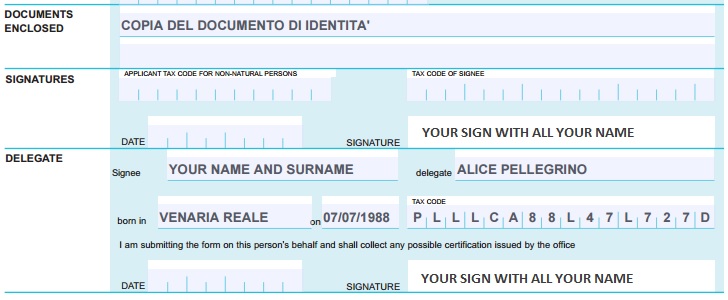

In the section DOCUMENTS ENCLOSED you have to write “copia del documento di identità”, which means a copy of the identity document. In fact, with the form, you must also send me a photocopy or photograph of your passport.

In the field SIGNATURES, you must sign up with all your names and you have to enter the date.

Finally, in the field DELEGATE, there are to enter my data. You find them already indicated in the example below. And again your sign.

Obviously, if you want to personally go to the Inland Revenue (the nearest is to Borgomanero) it is not necessary to fill in the proxy field.

I repeat that the fiscal code is free.

PEOPLE WHO SPEAK GERMAN

PEOPLE WHO SPEAK GERMAN

Click here to download the German language form Fiscal Code (German)

Click here to download some information German language Instruction for fiscal code (German)

PEOPLE WHO SPEAK ENGLISH

PEOPLE WHO SPEAK ENGLISH

Click here to download the English language form Fiscal Code (English)

Click here to download some information in English Instruction for fiscal code (English)

PEOPLE WHO SPEAK SPANISH

Click here to download the Spanish language form Fiscal Code (Spanish)

Click here to download some information in Spanish Instruction for fiscal code (Spanish)

PEOPLE WHO SPEAK FRENCH

PEOPLE WHO SPEAK FRENCH

Click here to download the French form Fiscal Code (French)

Click here to download some information in French Instruction for fiscal code (French)

I hope I have clarified all your questions, but do not hesitate to contact me for further clarification. Write to me info@ortalloggi.com.

Alice – www.ortalloggi.com